Is it worth investing in Edinburgh Investment Trust right now?

Edinburgh Investment Trust is one of the few funds that can say it overlapped with the reign of Queen Victoria. Founded in 1889, the £1 billion London-listed trust has built a long and impressive track record of beating London’s stock market, so a double-digit discount on the shares certainly warrants attention.

The trust invests in British stocks with a long-term aim of beating the FTSE all-share index and securing dividend growth that is beyond the rate of inflation. Personal care, drug and grocery store stocks feature most prominently in the £1.3 billion portfolio, together accounting for 14.7 per cent of its assets. That is followed by pharmaceuticals and biotechnology at 12.1 per cent, industrial support services at 9.7 per cent and oil, gas and coal at 7.7 per cent as of the end of July.

Overall the fund has 48 different equity investments, but its biggest single holding is the energy giant Shell, at 8.1 per cent, followed by the consumer goods business Unilever at 5.6 per cent, and the catering group Compass at 5.1 per cent.

The fund, which is not to be confused with the smaller Edinburgh Worldwide Investment trust managed by Baillie Gifford, pegs its performance against the FTSE all-share. But 83 per cent of the portfolio is invested in larger names in the FTSE 100, with the remainder mostly in the FTSE 250 group. The trust has consistently outperformed all three indexes: in the past five years it has delivered a total return of 60 per cent, compared with 35 per cent from the FTSE 100, 33 per cent from the FTSE all-share and 18 per cent from the FTSE 250.

The trust sits in the UK equity income sector, though it yields a relatively unimpressive 3.8 per cent, slightly ahead of the 3.6 per cent in the FTSE all-share but lower than the average of 4.1 per cent among its rival funds. But there is still strong potential for long-term dividend growth, with a stable of steady compounders in the portfolio. Shareholder payouts also look well supported by the trust’s capital revenue reserves that stood at 30.7p per share at the end of its financial year in March. This meant its full-year dividend was covered by revenue reserves at a multiple of 1.1, according to analysis by Kepler Trust Intelligence, a research firm.

The trust, whose investments are managed by Liontrust, also recently negotiated lower management fees that came into effect in April. It now has a tiered fee of 0.45 per cent each year on the first £500 million of market capitalisation, 0.4 per cent on the next £500 million and 0.35 per cent on the remainder. Based on its market capitalisation at the end of its last year, the restructuring is expected to reduce the pro-forma management fee by about 11 per cent compared with the old structure.

Potential investors should also be aware that there has been a recent management change: the veteran manager James de Uphaugh announced his retirement last October. Imran Sattar, who like Uphaugh joined Liontrust in 2022 as part of its acquisition of the investment boutique Majedie, became the lead portfolio manager in February.

Despite Edinburgh Investment Trust’s consistent outperformance, its shares trade at a 10 per cent discount to their net assets. The trust’s board has tried to remedy this by buying back shares, but it still looks far too wide given the strength of the portfolio and its robust record.

The discount may be helped by news this week that the government and Financial Conduct Authority, the City regulator, have temporarily suspended a cost disclosure rule that was harming appetite for investment trusts, which should help revive demand for funds across the sector. A re-rating is unlikely to appear quickly, but a quality, longstanding name such as the Edinburgh Investment Trust should stand to gain.

Advice:Buy Why? Consistent outperformer at a double-digit discount

Cordiant Digital Infrastructure

The Cordiant Digital Infrastructure trust is one of many infrastructure funds that are trading well below the value of their net assets. But with lower interest rates and help around a cost disclosure issue, the clouds looming over the sector could be about to part.

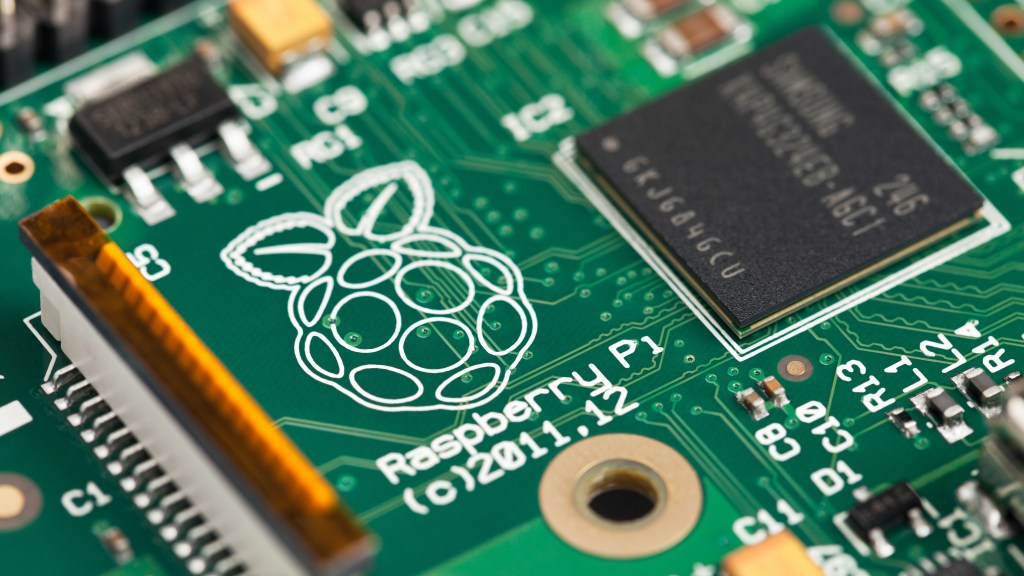

Cordiant is designed to give investors exposure to the infrastructure that supports the digital economy, including data centres, telecommunications towers and fibre networks. The trust, which was the first digital infrastructure fund to list on the London market in 2021, has invested its £1 billion portfolio in five assets that together hold nine data centres, more than 1,000 towers and stakes in more than 10,000km of fibre networks.

Cordiant certainly compares well with Digital 9 Infrastructure, a rival fund, which this month wrote down its net asset value by around 43 per cent after obtaining an independent valuation on some companies in its portfolio.

Cordiant remains well respected in the City, with a portfolio of cash-generative companies, no debt maturing until 2029 and a well-covered dividend.

Indeed, the fund, which has a yield of 4.9 per cent, offers shareholder payouts that are covered 4.5 times by its portfolio’s adjusted cash profits and 1.6 times by free cashflow, after continuing costs. An update earlier this month showed that revenues generated by the companies in the portfolio grew 9 per cent in first quarter of its financial year, with adjusted cash profits up by 14 per cent.

Still, the troubles at Digital 9 — its shares are down by more than 60 per cent in the past 12 months alone — have shaken investor confidence in the sector. This goes some way to explain why Cordiant’s shares still trade at a third below their net asset value, even with a 10 per cent rally in the price so far this year.

Given the progress between the government and the FCA on cost disclosure rules, which have hit infrastructure funds particularly hard, and good progress within the portfolio, Cordiant’s rally looks like it still has a way to go yet.

Advice: BuyWhy? Brighter outlook for infrastructure trusts

Publicar comentario